Check Form 941 Worksheet 1 Irs

You can get Form 941 Worksheet 1 Irs. Learn how to e file form 941 also known as the employer s quarterly return this form is most used to report employee p irs forms irs gov instructional design. irs tax forms tax forms capital gain. pleting your small business taxes with irs form 941 the blueprint. 22 printable form 941 templates fillable samples in pdf word to download pdffiller. irs 941 2017 fill and sign printable template online us legal forms Related topic : Worksheet

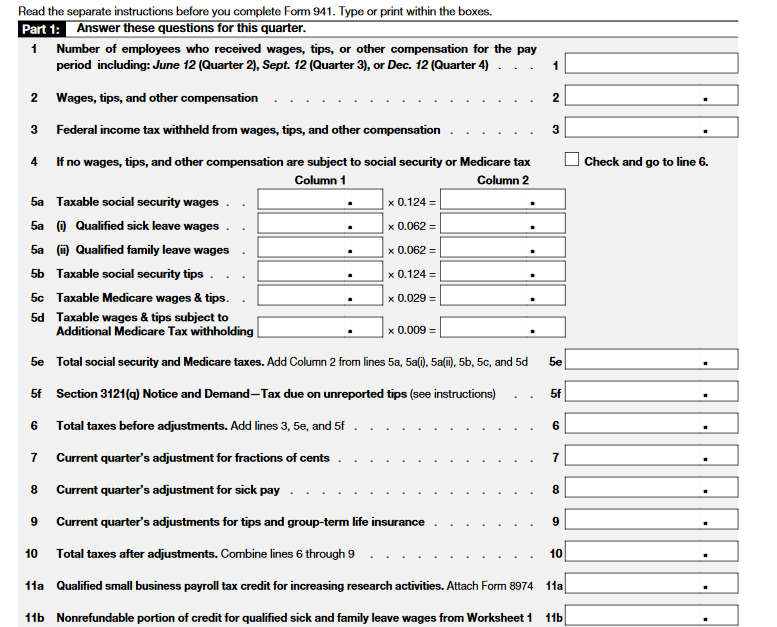

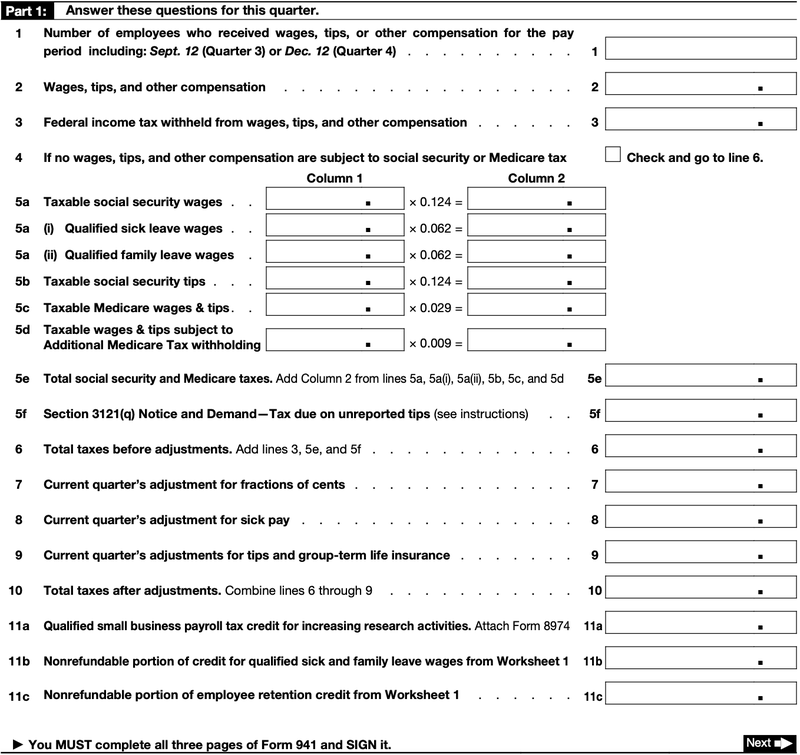

EFTPS-Direct Payments Worksheet Short Form Photocopy this 941 tax payment worksheet for future use. Worksheet 1 in the Instructions for Form 941 can help you calculate your tax refunds and deferments for the qualified Credit for Sick and Family Leave and the Employee Retention Credit.

Wait What I Have To Pay Taxes 4 Times A Year What You Need To Know About Taxes And Self Employment Mi Independent Contractor Taxes Job Info Finance Saving

Usually Form 941 due date falls by the last day of the month following the reporting quarter.

If youre required to file Forms 941 but believe your employment taxes for calendar year 2021 will be 1000 or less you may request to file Form 944 instead of Forms 941 by calling the IRS at 800-829-4933 between January 1 2021 and April 1 2021 or sending a written request postmarked between January 1 2021 and March 15 2021. Line 11b Nonrefundable Portion of Credit for Qualified Sick and Family Leave Wages From Worksheet 1. Prior revisions of Form 941 are available at IRSgovForm941 select the link for All Form. Take a look at the following topics to get a comprehensive understanding of the things you need to know before paper filing a Form 941 return. Updated on March 04 2021 - 1030 AM by Admin ExpressEfile Team. Form 941 Mailing Address.

Pleting Your Small Business Taxes With Irs Form 941 The Blueprint

Date Time Formula Wizard For Excel Excel Subtraction Dating

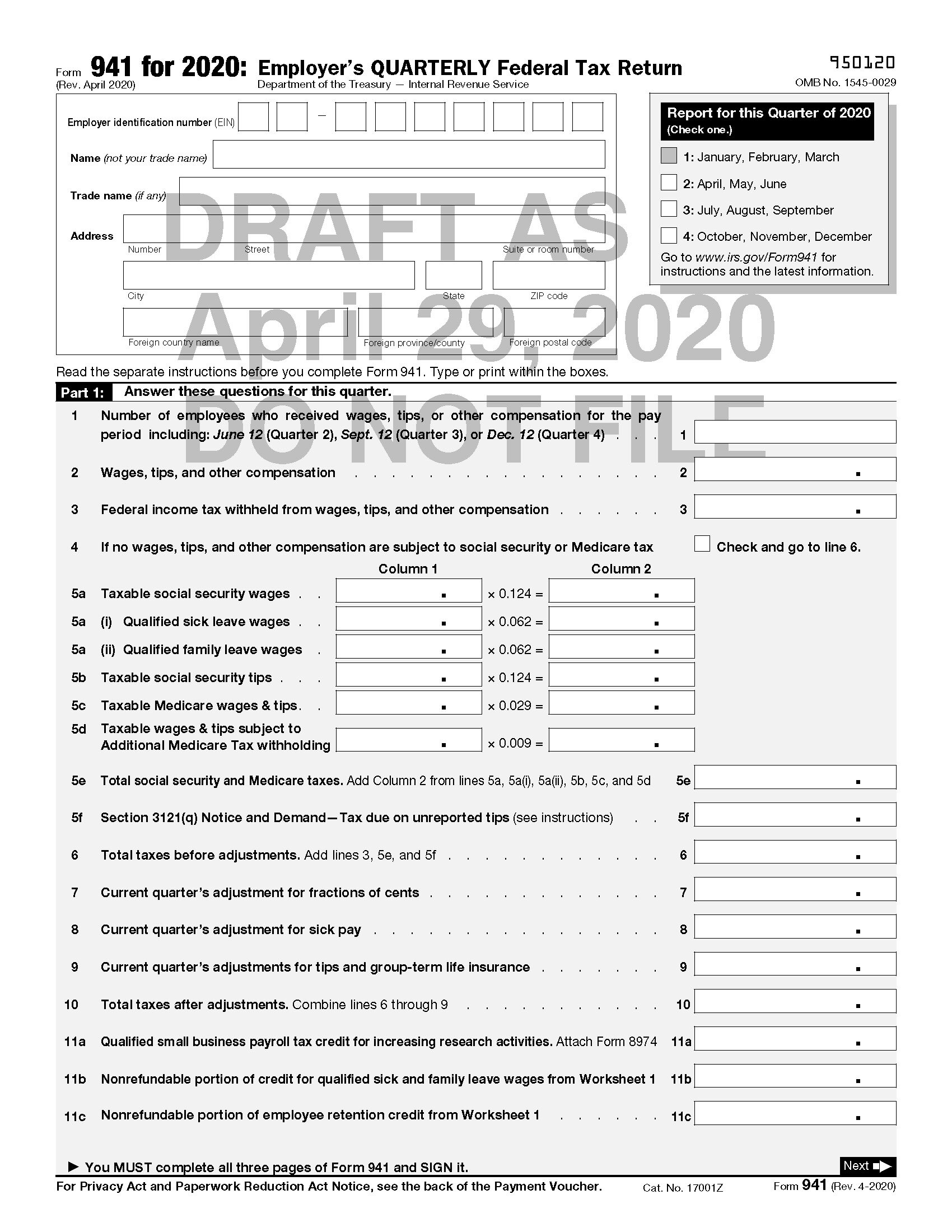

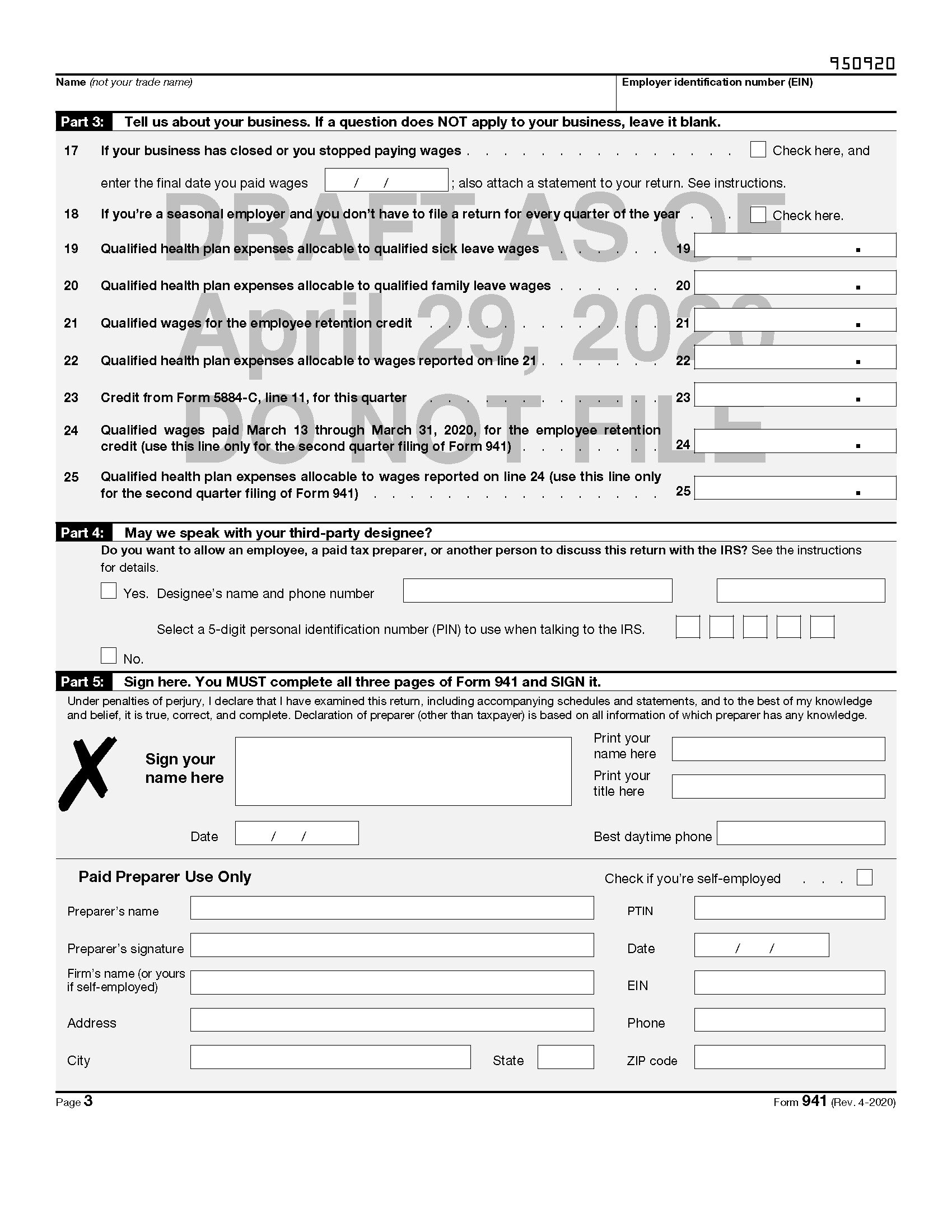

Draft Of Revised Form 941 Released Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

Draft Of Revised Form 941 Released Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

Irs Tax Forms Tax Forms Capital Gain

Formulaire W 8 Ben Mars 2016 A Remplir Pour Spreadshirt Par Exemple State Tax Teachers College Business Administration

Learn How To E File Form 941 Also Known As The Employer S Quarterly Return This Form Is Most Used To Report Employee P Irs Forms Irs Gov Instructional Design

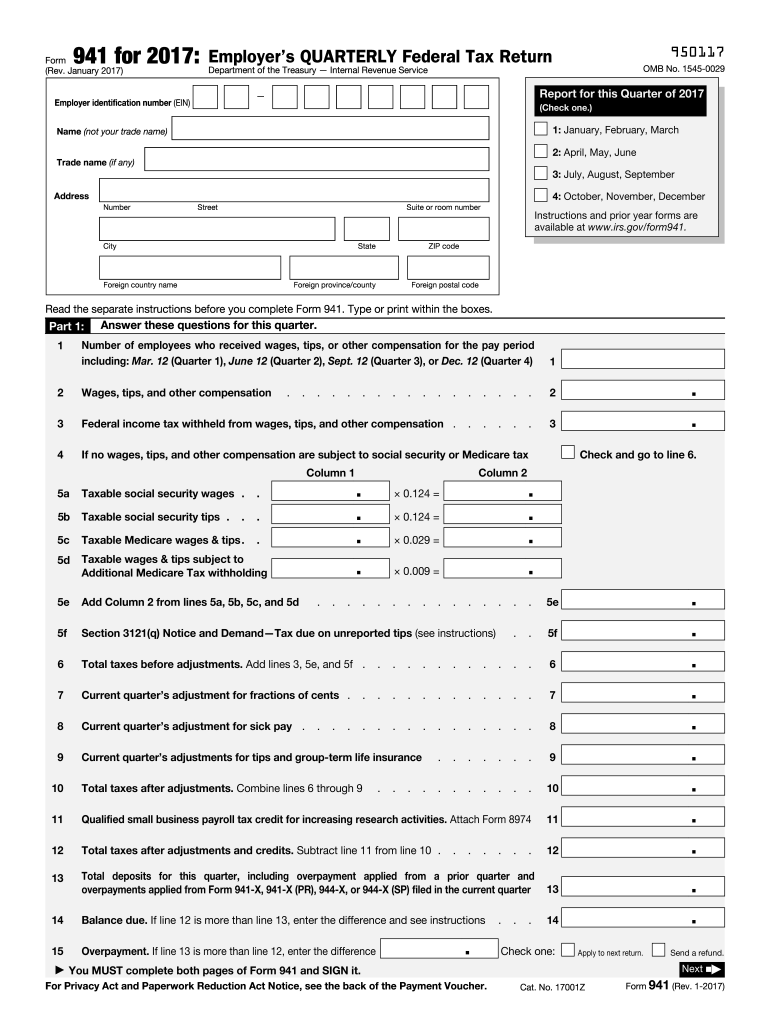

Irs 941 2017 Fill And Sign Printable Template Online Us Legal Forms

Draft Of Revised Form 941 Released Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

22 Printable Form 941 Templates Fillable Samples In Pdf Word To Download Pdffiller

How To Prepare And File Irs Forms 940 And 941 The Blueprint

An employer would use the new Worksheet 1 within the instructions for the revised Form 941 to calculate the amount of the combined credit for qualified sick leave wages and qualified family leave wages for which it is eligible with respect to the reported quarter. Employers who file Form 941 Employers QUARTERLY Federal Tax Return must file the revised form with COVID-19 changes from Quarter 2 of 2020Now IRS has revised the Form 941 for Q2 2021 which the filers must use for the second quarter of 2021. The IRS Form 941 Employers QUARTERLY Federal Tax Return must be filed by employers to report the federal income taxes withheld from employees employee and employer share of social security and Medicare FICA taxes.

Here is all you need to learn about Form 941 Worksheet 1 Irs, How to prepare and file irs forms 940 and 941 the blueprint draft of revised form 941 released irs includes ffcra and cares provisions current federal tax developments draft of revised form 941 released irs includes ffcra and cares provisions current federal tax developments date time formula wizard for excel excel subtraction dating wait what i have to pay taxes 4 times a year what you need to know about taxes and self employment mi independent contractor taxes job info finance saving draft of revised form 941 released irs includes ffcra and cares provisions current federal tax developments

Posting Komentar

Posting Komentar